Meat Alternatives Losing Ground with Consumers

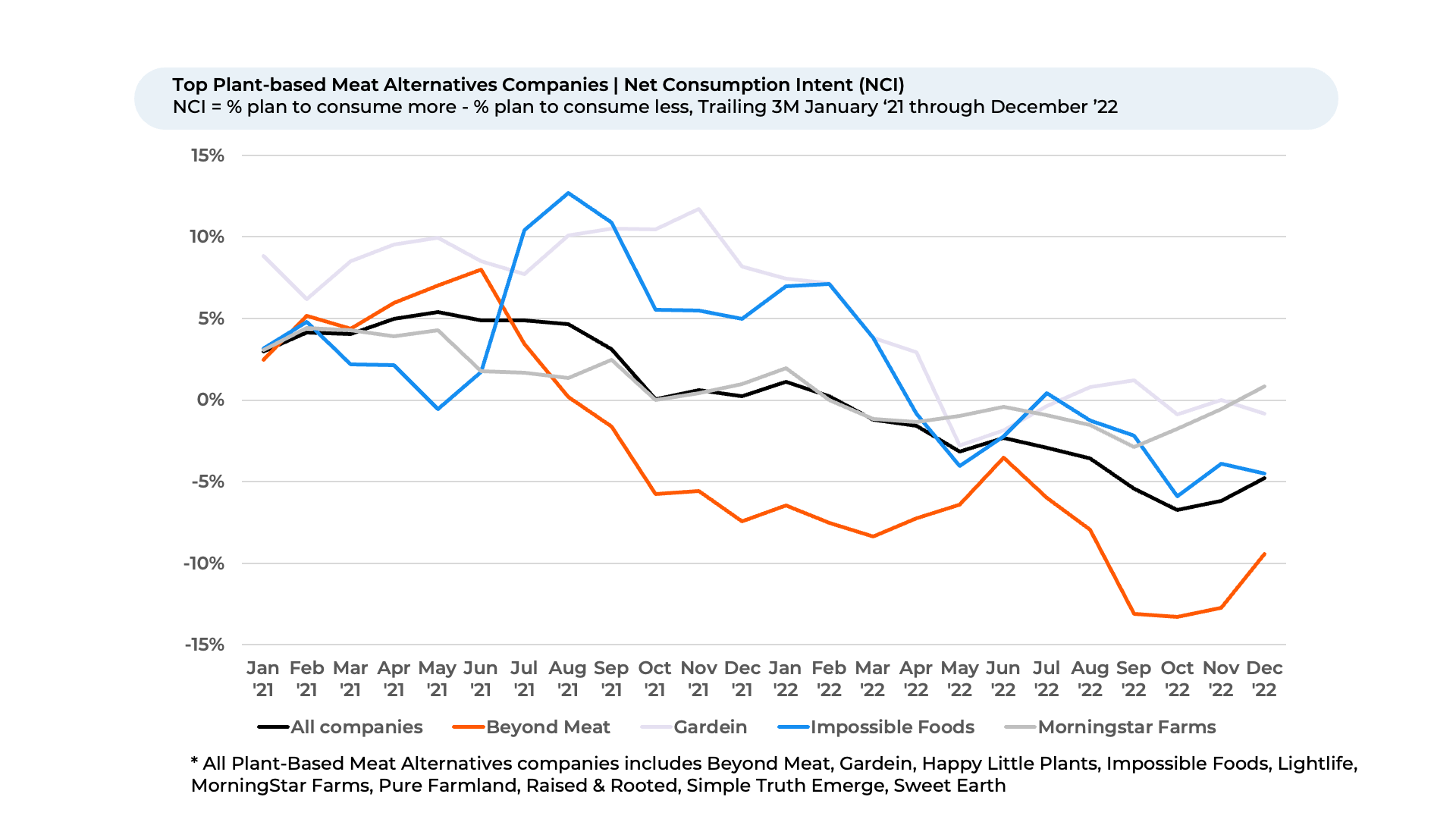

In the latest round of layoff headlines, plant-based meat alternative brands are preparing to reduce headcount amid declining popularity with consumers. Earlier this week Bloomberg reported on Impossible Foods preparing to reduce its workforce. This follows workforce reductions occurring last August at Beyond Meat, Inc., in response to slumping sales as reported by the L.A. Times. Both articles cite recent data from "The Crowd” of 17,000 real consumers telling HundredX they plan to consume less over the next year.

Faux meats garnered praise in the early days of the COVID-19 pandemic as a better option for consumers looking to boost their health and immunity. However, plant-based meat alternatives have not been successful maintaining their early momentum stealing market share from traditional meat products. HundredX data shows gains with customers in 2021, but a loss of ground over the past year.

Our key findings can be summarized as follows:

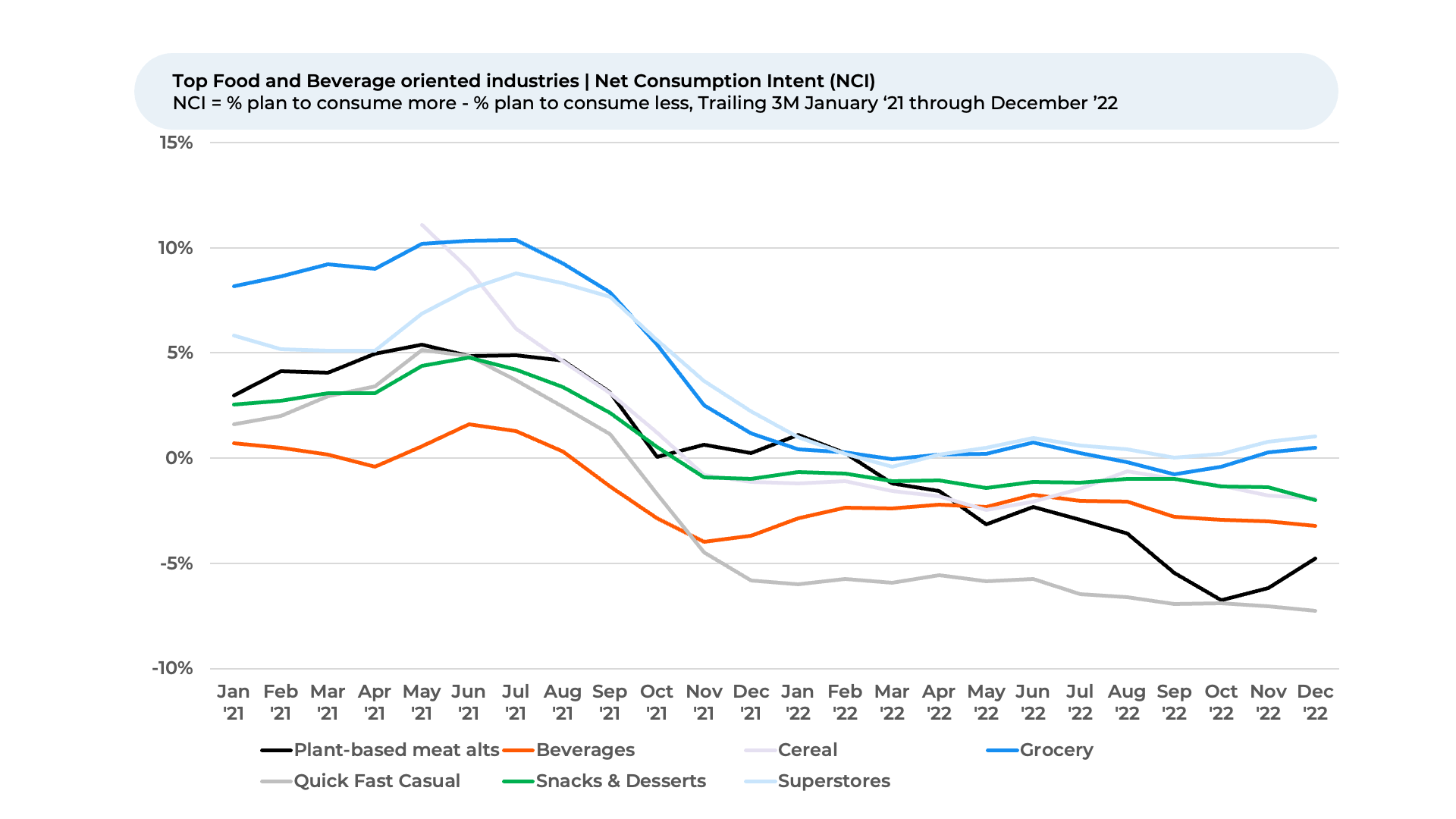

Consumption Intent1 has been stable/rangebound for most food and beverage-oriented industries over the last year, while Plant-based meat alternatives has dropped significantly.

Consumption Intent for the largest plant-based meat alternative largest brands have all fallen since Summer 2021. Over the last six months Intent has held up better for Morningstar Farms and Gardein than the two largest brands in the space.

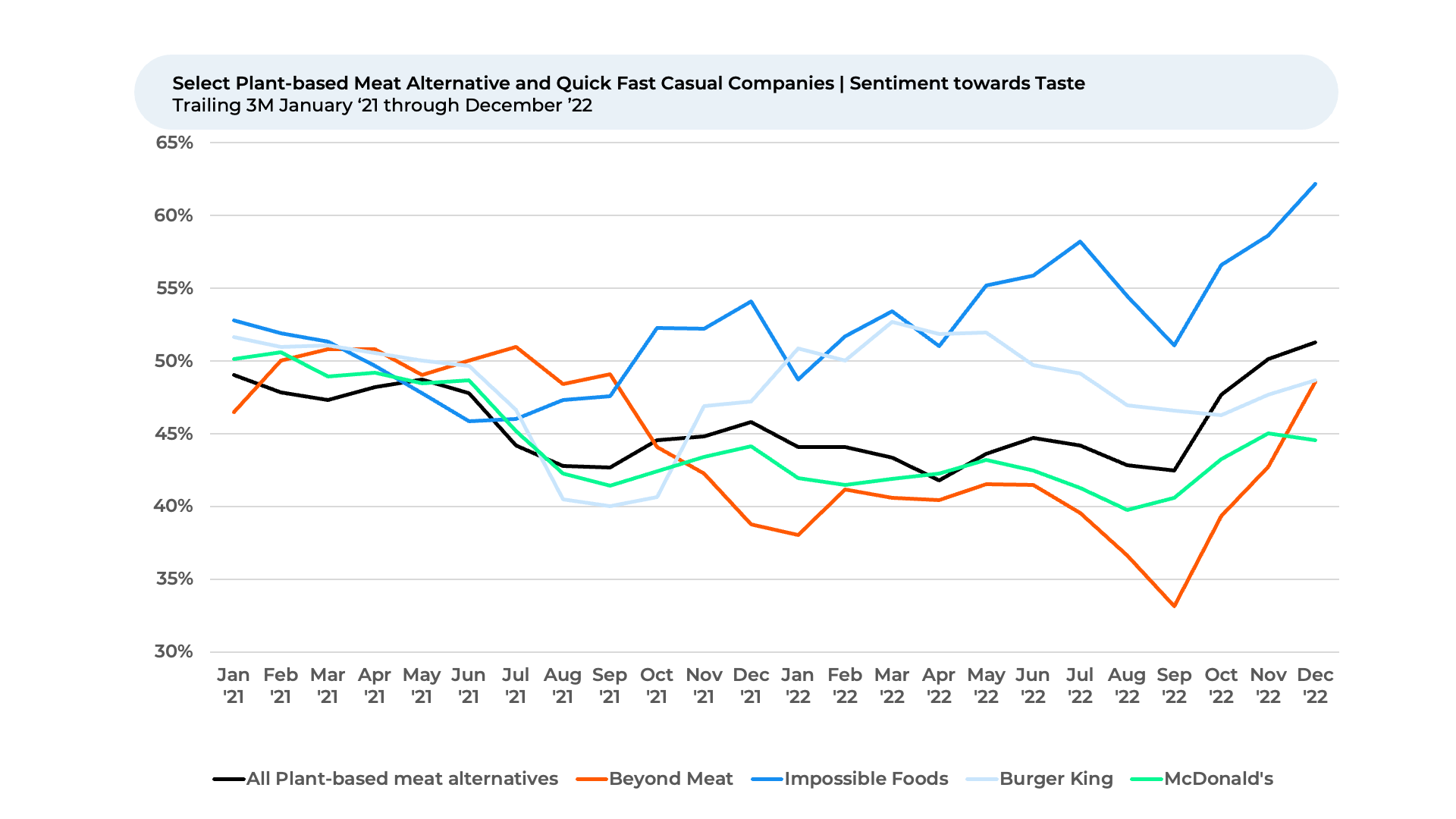

Taste, Availability and Price are the top drivers of customer satisfaction for the Plant-based meat alternatives. Sentiment towards Taste for Impossible Foods leads meat-alternative peers and the largest burger-focused quick service restaurants.

For more information on the food and beverage businesses we cover, please contact our team.

1. Consumption intent represents the percentage of customers that plan to consume more of the brand over the next twelve months minus the percentage that plan to consumer less

2. HundredX measures sentiment as the percentage who say the factor is a reason they like the brand minus the percentage who say the factor is a reason they do not like it

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on coverage of any of our 75+ industries, or if you'd like to understand more about using Data for Good, please reach out to our team.

See where businesses and industries are going

All Rights Reserved | HundredX, Inc