As the holidays quickly approach, consumers are already opening their wallets at unprecedented levels. A record 200.4 million people scoured stores and websites from Thanksgiving through Cyber Monday, according to the National Retail Federation, leading the organization to predict record holiday spending up 3% to 4% vs. last year.

With many people watching to see if the strong spending growth continues through the end of the year, softer HundredX datapoints for November indicate that growth may moderate a bit and buyers are starting to feel some pricing fatigue, particularly for digital services.

Analyzing millions of pieces of customer feedback from July 2021 across 80+ industries and 3,000+ companies, we find:

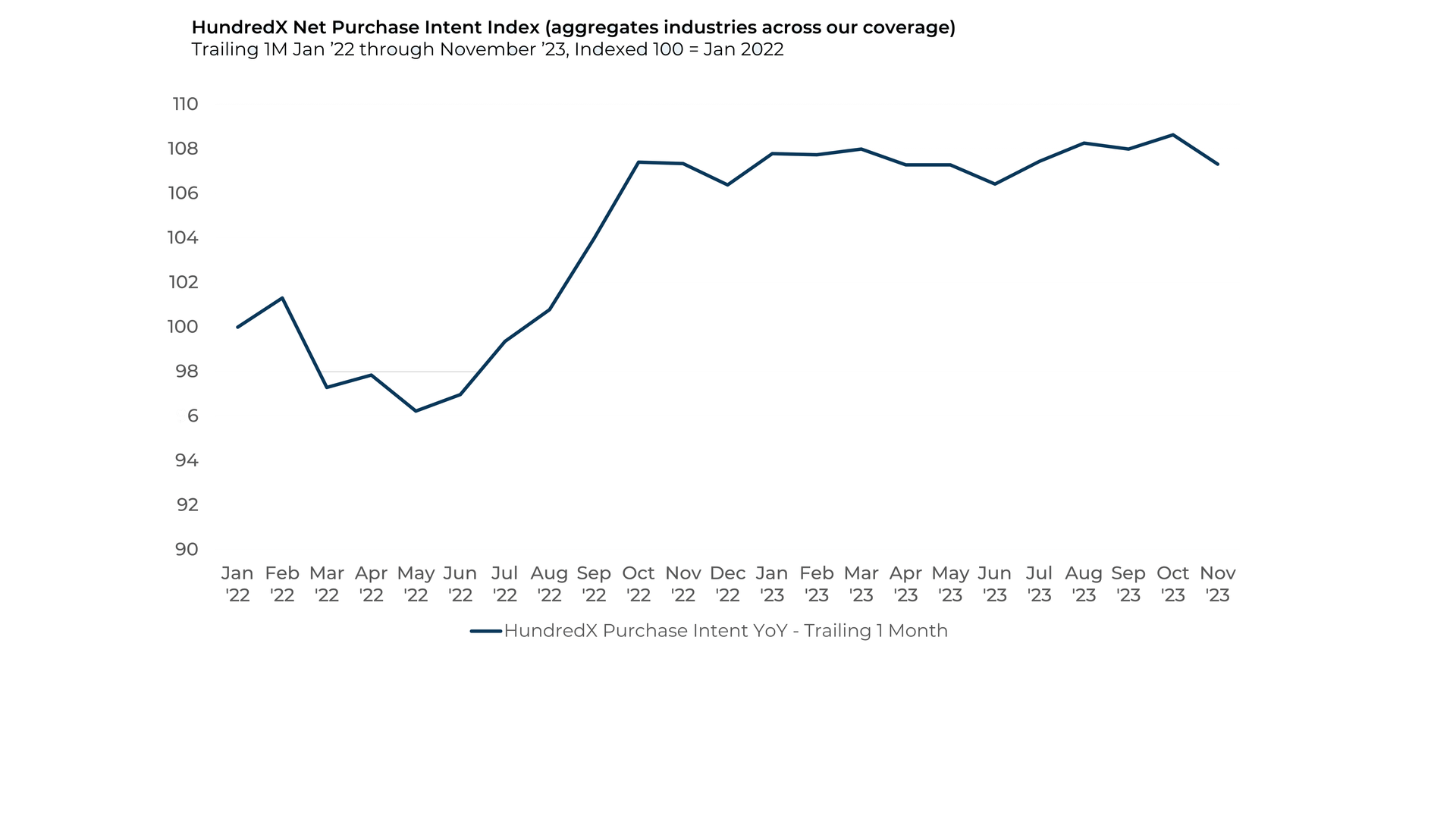

- HundredX’s Net Purchase Intent¹,² Index fell 1% over the past month, indicating customers expect to keep spending but may grow that spend less in the coming months. We will look to the December datapoint to see if a softening trend may be emerging.

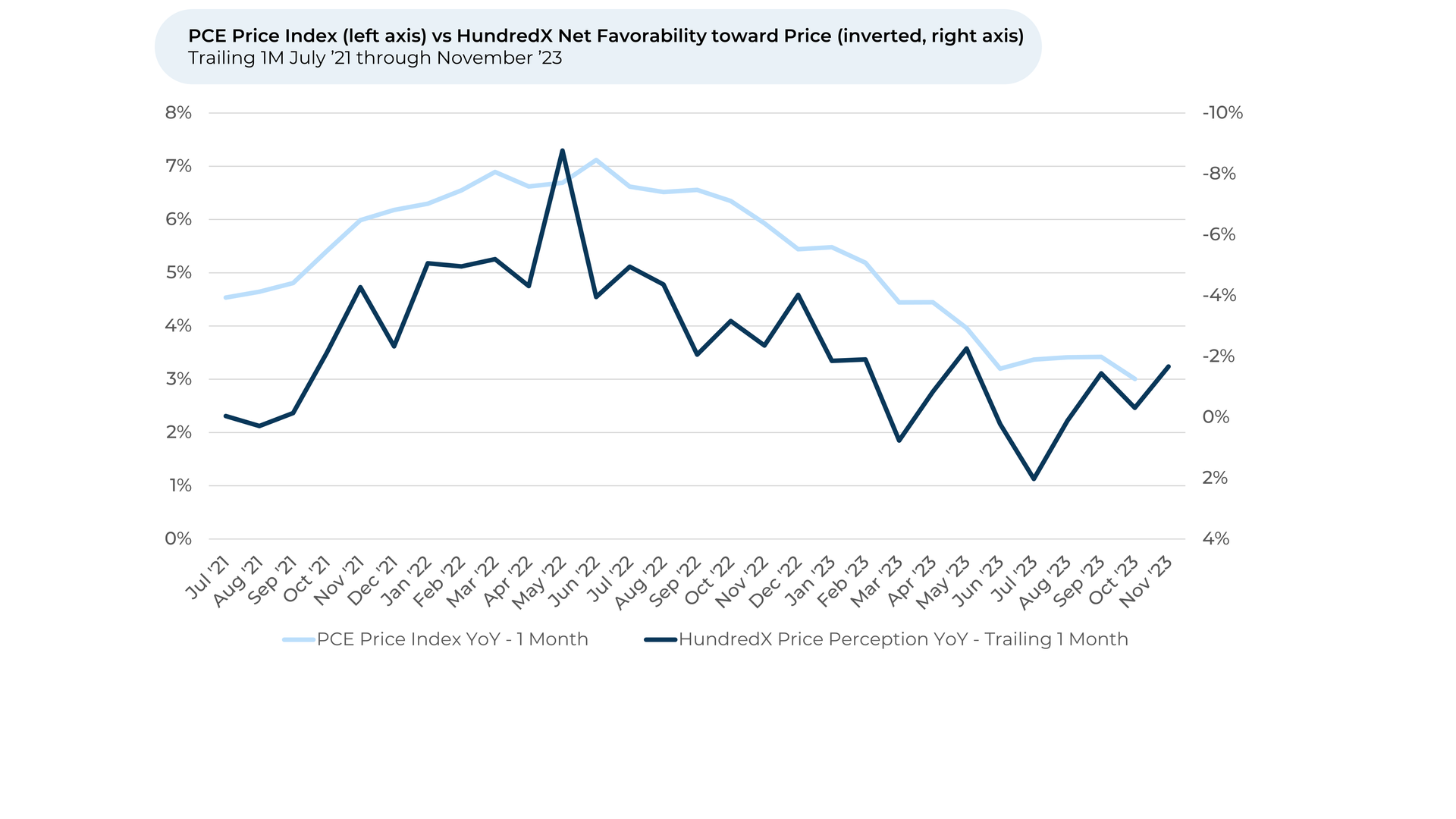

- Over the past month, customers’ aggregate perception of prices across the economy fell by about 1.5%, putting it at its lowest level since May and showing inflation’s stickiness. Perception improved from a trough in summer 2022 to a recent peak in July 2023, but has fallen 3 of 4 months since then.

- Changes in HundredX’s Price favorability³ index are typically inversely correlated with movement in the Personal Consumption Expenditures (PCE) Price levels (i.e. inflation) reported by the US government.

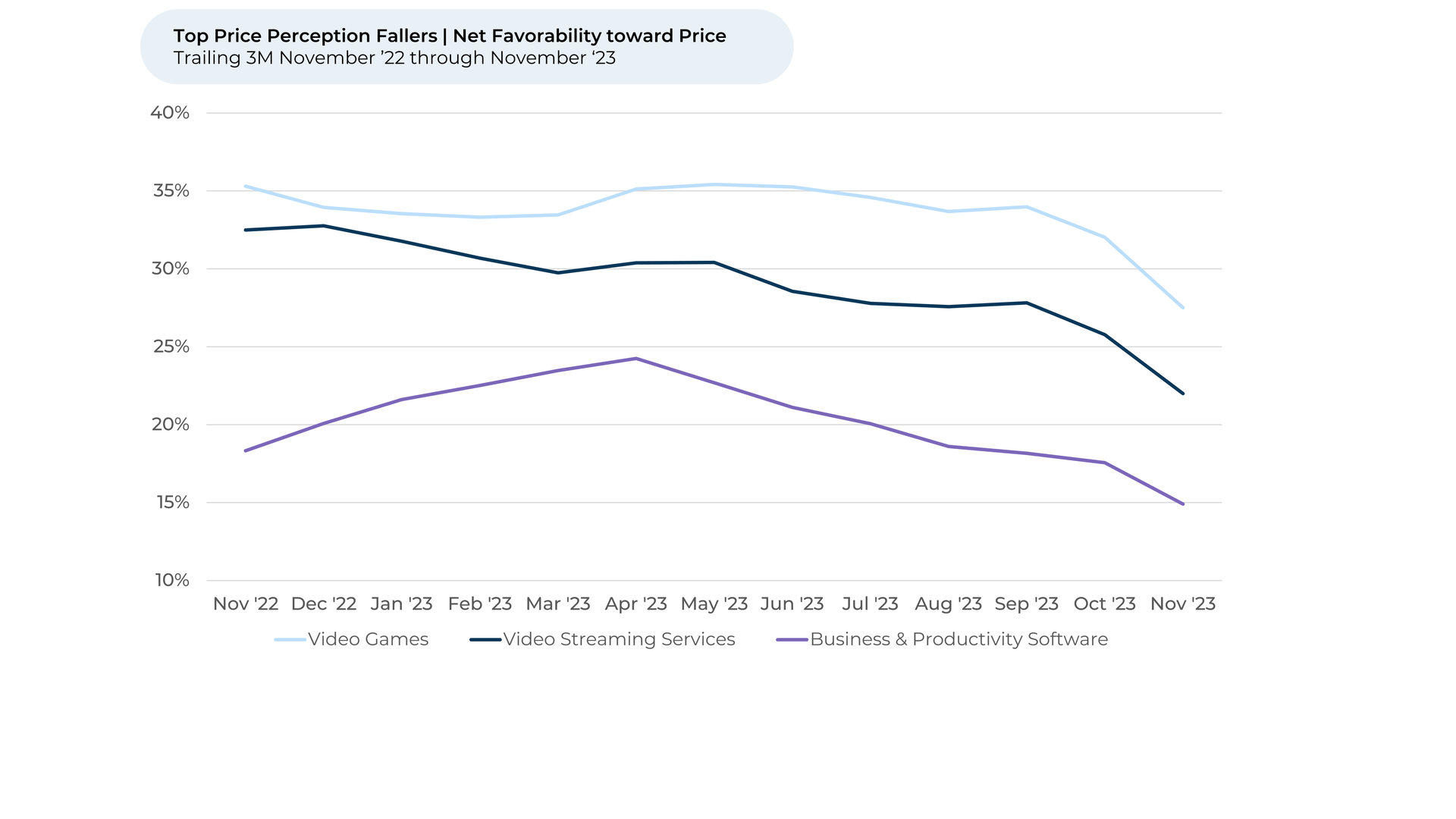

- Customers feel increasingly disenchanted with the prices of digital goods and services. Price favorability fell 4% - 6% over the past three months for video games, video streaming, business software, and cable and internet providers – more than any other industries.

The discontent reflects backlash against game and software developers increasingly turning to subscriptions, and the rising costs of video streaming services. Usage Intent² (video streaming, business software) and Purchase Intent (video games) fell 1% - 3% over the past three months.

Slide title

Write your caption hereButton

Slide title

HundredX’s Purchase Intent Index also fell over the past month (-1%), reversing

growth we saw since the summer. Consumers expect to continue spending, but may

plan on growing that spend less in the coming months.

Button

Slide title

Price sentiment fell slightly (-1.5%) over the past month, putting it at its lowest since May

2023 and showing inflation’s stickiness.

Button

Slide title

Digital Industries – video games, video streaming, and business and productivity software –

have seen some of the largest declines in price perception over the past three months. The

4% - 6% drop signals pricing fatigue following series of price increases.

Button

Please contact our team for a deeper look at HundredX's data insights into the broader economy or specific sectors, industries, or demographic groups.

- All metrics presented, including Net Purchase (Purchase Intent) and Net Positive Percent / Favorability, are presented on a trailing three-month basis unless otherwise noted.

- Usage Intent represents the percentage of customers who expect to use that brand/service over the next 12 months, minus those who intend to use less. Purchase Intent is the percentage of customers who plan to buy more from a brand minus those who intend to buy less. We find businesses that see Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.

- HundredX measures Net Favorability towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

See where businesses and industries are going

All Rights Reserved | HundredX, Inc